Question:

Answer:

Thank you for trusting LHLegal with your inquiry. Regarding the establishment of a company in Vietnam by a person who is applying for an overseas visa, we provide the following legal analysis:

Conditions for Establishing a Company in Vietnam While Applying for an Overseas Visa

Pursuant to Clauses 1 and 2, Article 17 of the Law on Enterprises 2020, the right to establish and manage an enterprise in Vietnam is regulated as follows:

Right to Establish and Manage an Enterprise

Organizations and individuals have the right to establish and manage enterprises in Vietnam, except for the following prohibited subjects:

-

State authorities and units of the armed forces using state assets to establish enterprises for private gain

-

Cadres, civil servants, and public employees under relevant laws

-

Officers, non-commissioned officers, professional soldiers, defense workers, and police officers, except those authorized to manage state capital

-

Senior managers of state-owned enterprises (with limited exceptions)

-

Minors; persons with restricted or lost civil act capacity; persons with cognitive or behavioral difficulties; organizations without legal personality

-

Persons under criminal investigation, detention, imprisonment, administrative sanctions, or court-imposed prohibitions

-

Commercial legal entities prohibited from doing business under criminal law

Where required, the business registration authority may request a criminal record certificate from the applicant.

Legal Conclusion

A person who is applying for an overseas visa does not fall within the prohibited categories above. Therefore, such a person is legally entitled to establish a company in Vietnam.

Additionally, enterprise founders must have a clear lawful permanent or temporary residence address in Vietnam. If a visa applicant still maintains lawful residence in Vietnam, the visa application does not affect eligibility to establish a company.

If the founder leaves Vietnam for an extended period, they may appoint another person as the companyŌĆÖs legal representative

Conditions Applicable to the Legal Representative of the Company

Key requirements for a legal representative include:

-

The legal representative is responsible for managing and operating the company

-

The company must always have at least one legal representative residing in Vietnam

-

If the company has only one legal representative residing in Vietnam and that person leaves the country, they must authorize another individual residing in Vietnam in writing to perform the rights and obligations of the legal representative

If the company founder is also the legal representative and plans to stay abroad for an extended period after obtaining the visa, they must ensure one of the following:

-

Appoint another person as legal representative in Vietnam; or

-

Establish appropriate authorization and remote management arrangements through lawful documentation

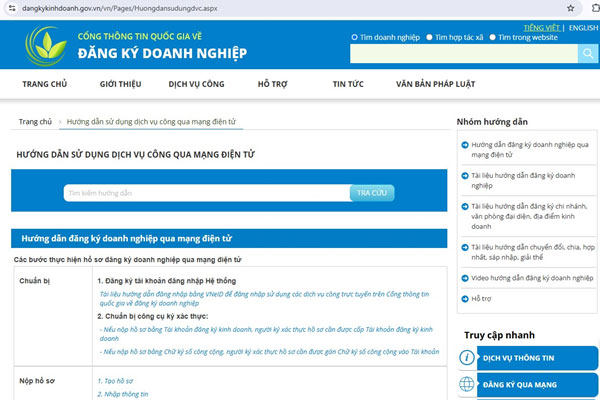

Online enterprise registration

Key Notes for Visa Applicants Intending to Establish a Company

If you are applying for an overseas visa and intend to establish a company, you should:

-

Appoint a legal representative to handle legal and administrative matters during your absence

-

Prepare a lawful power of attorney, clearly defining authority and responsibilities

Procedures for Company Establishment in Vietnam

Enterprise Registration Process

Under Article 26 of the Law on Enterprises 2020, enterprise registration may be carried out through the following methods:

-

Direct submission at the Business Registration Office

-

Submission via postal services

-

Online submission via the National Business Registration Portal

Online enterprise registration involves submitting an electronic dossier via the National Business Registration Portal. Such dossiers have equal legal validity to paper-based dossiers.

Applicants may use:

-

A digital signature; or

-

A business registration account issued by the national system

Within 03 working days from receipt of a valid dossier, the Business Registration Authority shall issue the Enterprise Registration Certificate or notify the applicant in writing of any required amendments or reasons for refusal.

Visa applicants follow the same procedures as other enterprise founders.

Types of Enterprises Suitable for Visa Applicants

Depending on management capacity and business plans, the following enterprise types are recommended:

Single-Member Limited Liability Company (LLC)

Suitable if:

-

You wish to be the sole owner

-

You prefer limited liability (within contributed capital)

Advantages:

-

Easy to manage while abroad

-

Flexible appointment of legal representatives or authorized managers

Disadvantages:

-

Limited capital mobilization

-

No issuance of shares

Multi-Member Limited Liability Company (2ŌĆō50 Members)

Suitable if:

-

You have partners sharing management responsibilities

-

You anticipate frequent absence from Vietnam

Advantages:

-

Flexible legal representative structure

-

Limited liability

Disadvantages:

-

Requires consensus among members for major decisions

-

No issuance of shares

Joint Stock Company (JSC)

Suitable if:

-

You aim for large-scale operations

-

You intend to raise capital from multiple investors

Advantages:

-

Capital mobilization through share issuance

-

No limit on number of shareholders

Disadvantages:

-

More complex corporate governance

-

Requires professional management capacity

Enterprise Types Not Recommended

-

Private Enterprises: Unlimited liability and no substitute legal representative

-

General Partnerships: Unlimited liability for general partners and restricted delegation of management authority

A joint stock company can easily raise capital through the issuance of shares

Registration Dossier Requirements

For LLCs and JSCs, dossiers are prepared in accordance with Decree No. 01/2021/N─É-CP, including:

Single-Member LLC

-

Application for enterprise registration

-

Company charter

-

Legal identification documents of the legal representative and owner

-

Investment Registration Certificate (if applicable)

Multi-Member LLC and Joint Stock Company

-

Application for enterprise registration

-

Company charter

-

List of members/shareholders

-

Legal identification documents of members, shareholders, and authorized representatives

-

Investment Registration Certificate (if applicable)

Foreign organizational documents must be consularly legalized.

Impact of Absence from Vietnam During Company Formation

If the legal representative is abroad, potential issues include:

-

Inability to sign documents on time

-

Delays due to original signature requirements

-

Extended processing time for notarization or authentication abroad

Recommended Solutions

-

Sign all documents before leaving Vietnam

-

Use digital signatures where legally permitted

-

Execute a power of attorney authorizing another individual to sign and submit documents

Legal Issues to Note When the Legal Representative Is Abroad

-

Companies may have one or multiple legal representatives, whose rights and obligations must be clearly defined in the charter

-

The company must always maintain at least one legal representative residing in Vietnam

-

If the sole legal representative is absent for over 30 days without authorization, the owner or governing body must appoint a replacement

-

Authorized acts remain the responsibility of the legal representative

Authorized tasks may include:

-

Contract execution

-

Working with state authorities

-

Internal management activities

All powers of attorney must be in writing, notarized or authenticated, and specify scope, duration, and responsibilities.

Disclaimer

This article is based on the specific facts provided and is for reference purposes only. It does not replace official decisions by competent authorities and may vary depending on actual circumstances.

Any citation or application of this content must clearly reference LHLegal Law Firm. Unauthorized or out-of-context use is at the userŌĆÖs own legal risk.

If you have any questions or need legal advice, please contact us via the following forms:

Hotline for direct consultation by our Legal team: 1900 2929 01

Register your information for a legal consultation here: https://luatsulh.com/dang-ky-tu-van.html

Phone number via zalo for setting up appointments: 0903 796 830

Website: https://luatsulh.com/

Main office address: 12A Nguyen Dinh Chieu Street, Tan Dinh Ward, Ho Chi Minh City (Formerly: Da Kao Ward, District 1)

Nha Trang Branch office address: 144 Hoang Hoa Tham Street, Nha Trang Ward, Khanh Hoa Province (Formerly Loc Tho Ward, Nha Trang City)

Follow LHLegal Law Ltd. at:

Website: https://luatsulh.com/

Facebook: Luß║Łt sŲ░ LHLegal

Youtube: Luß║Łt sŲ░ LHLegal

Lawyer H├▓aŌĆÖs TikTok channel: Luß║Łt sŲ░ Ho├Ā (LHLegal)

Our CompanyŌĆÖs TikTok channel: Luß║Łt sŲ░ LHLegal

Criminal LawyerŌĆÖs TikTok channel: Luß║Łt sŲ░ H├¼nh sß╗▒

|

|

Safe Real Estate Investment in Nha Trang: Why Foreign Investors Need a Lawyer from the Start (19.12.2025)

5 Common Real Estate Disputes Foreigners Face When Investing in Nha Trang (19.12.2025)

What Types of Property Can Foreigners Own in Nha Trang? (19.12.2025)

Foreign InvestorsŌĆÖ Concerns When Investing in Assets Without Speaking Vietnamese (19.12.2025)

Why Do Many Foreigners Choose Nha Trang for Real Estate Investment? (19.12.2025)

Guidelines for Foreigners Adopting a Child in Vietnam (18.12.2025)

What Documents Are Required to Register a Marriage with a Foreigner? (18.12.2025)

Latest Guidance on Divorce Procedures Involving Foreign Nationals (18.12.2025)

Tß╗Ģng ─æ├Āi tŲ░ vß║źn ph├Īp luß║Łt:

Tß╗Ģng ─æ├Āi tŲ░ vß║źn ph├Īp luß║Łt:  Email: hoa.le@luatsulh.com

Email: hoa.le@luatsulh.com

![[TTMN] LHLegal vinh dß╗▒ ─æß║Īt Top 10 ThŲ░ŲĪng hiß╗ću Luß║Łt xuß║źt sß║»c quß╗æc gia: H├Ānh tr├¼nh vŲ░ŲĪn tß║¦m cao mß╗øi](thumb/86x85/1/upload/news/img_26202121_170x130.jpg)

![[KTCA] LHLegal - Tß╗▒ h├Āo l├Ā Top 10 ThŲ░ŲĪng hiß╗ću Luß║Łt xuß║źt sß║»c quß╗æc gia n─ām 2024](thumb/86x85/1/upload/news/img_26416668_170x130.jpg)

![[DNHN] - Gi├Īm ─æß╗æc L├¬ Nguy├¬n H├▓a - C├┤ng ty Luß║Łt LHLEGAL vinh dß╗▒ tr├¼nh ├Į kiß║┐n trŲ░ß╗øc Tß╗Ģng B├Ł thŲ░ T├┤ L├óm](thumb/86x85/1/upload/news/hiep-hoi-doanh-nghiep-nho-va-vua-tiep-kien-tong-bi-thu-chu-tich-nuoc-to-lam-83439_170x130.jpg)

![[TTO] C├┤ng ty luß║Łt LHLegal ─æß║Īt giß║Żi thŲ░ß╗¤ng ŌĆśDß╗ŗch vß╗ź - chß║źt lŲ░ß╗Żng quß╗æc gia 2023'](thumb/86x85/1/upload/news/lhlegal-dat-danh-hieu-san-pham-dich-vu-chat-luong-quoc-gia-26866_170x130.jpg)

![[TTO] - C├┤ng ty Luß║Łt LHLegal vinh dß╗▒ nhß║Łn c├║ ─æ├║p giß║Żi thŲ░ß╗¤ng cuß╗æi n─ām 2021](thumb/86x85/1/upload/news/nhan-giai-thuong-dich-vu-tot-thuong-hieu-noi-tieng-nam-20215757_170x130.jpg)

![[PLVN] C├┤ng ty Luß║Łt LHLegal vinh dß╗▒ lß╗Źt ŌĆ£Top 20 thŲ░ŲĪng hiß╗ću nß╗Ģi tiß║┐ng nhß║źt n─ām 2021ŌĆØ](thumb/86x85/1/upload/news/luat-su-va-cong-su-lhlegal-135930_170x130.jpg)